Shipbuilding: the new battleground in the US-China trade war

Labour unions are urging the Biden administration to investigate China’s dominance of naval engineering, potentially inflaming Sino-American tensions

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Shipping has been at the centre of the global economy for over 5,000 years, and it is no less important now than it was for our seafaring ancestors.

For all our technological advances, it is still the most effective means of importing and exporting goods and raw materials. It remains crucial to national security, not just for the long-standing role it has played in the defence of nations and of trade but also because today’s port software and logistics platforms hold crucial data about which countries and companies are moving goods around the world.

Even Adam Smith, the father of modern capitalism, believed that shipbuilding was one of the very few industries that deserved national support and should not be left to market forces alone.

That’s a key part of the argument being made in a new petition for trade relief and state support of the US shipbuilding industry under a so-called section 301 case filed by the United Steelworkers union and other labour organisations on March 12.

The petitioners accuse China of distorting global markets in the maritime, logistics and shipbuilding sectors through “unreasonable and discriminatory acts, policies, and practices”.

The petition, which the US government now has 45 days to respond to, seeks a variety of penalties and remedies to level the global playing field in shipbuilding and stimulate demand for commercial vessels built in the US. These include port fees on Chinese-built ships docking at US ports, and the creation of a Shipbuilding Revitalisation Fund to help the domestic industry and its workers.

A case that might appear focused on one industry in fact has dramatic global implications. Not only does it have the potential to reignite the US-China trade conflict, but it will also increase the focus on China’s growing military might and the massive commercial shipping industry that underpins it. At the same time, it raises questions about America’s ability and even willingness to reindustrialise in strategic sectors, which may bleed into the 2024 presidential election.

You are seeing a snapshot of an interactive graphic. This is most likely due to being offline or JavaScript being disabled in your browser.

Finally, it’s a window into whether the US has the ability to continue to play its traditional post-second world war security role, which includes policing global shipping lanes and securing the South China Seas for commercial transport, at a time when it no longer has the industrial capacity and workforce to build its own ships. The direction that the Biden administration takes on the case, and how China responds, will say much about the future economic and political shape of the world.

As the secretary of the navy, Carlos del Toro, put it in a speech at the Harvard Kennedy School last September, “History proves that, in the long run, there has never been a great naval power that wasn’t also a maritime power — a commercial shipbuilding and global shipping power.”

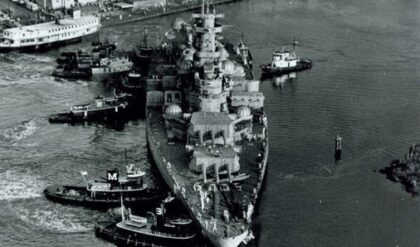

Over the past few decades, America has essentially stopped building its own ships.

In 1975, the US shipbuilding industry was ranked number one in terms of global capacity, with more than 70 commercial ships on order for production domestically. Nearly 50 years later, the US now produces less than 1 per cent of the world’s commercial vessels, falling to 19th place globally. China meanwhile has tripled its production relative to the US over the past two decades, producing over 1,000 ocean-going vessels last year, versus America’s 10.

The resulting asymmetry comes with both commercial and military concerns for the US, but also for any country that depends on it for security. More than 90 per cent of military equipment, supplies and fuel travels by sea, according to the 301 complaint, the vast majority on contracted commercial cargo vessels. All of these are made overseas, including some in China.

What’s more, the complaint says, “Chinese companies — primarily state-owned companies — have become leaders in financing, building, operating and owning port terminals around the world.”

According to research by Isaac B Kardon, an assistant professor at the China Maritime Studies Institute at the US Naval War College, and Wendy Leutert, an assistant professor at Indiana University, Chinese firms own or operate one or more terminals at 96 foreign ports, 36 of which are among the world’s top one hundred by container throughput.

“Another 25 of these top 100 are on the Chinese mainland, establishing a PRC nexus for some 61 per cent of the world’s leading container ports,” they wrote in a 2022 article in International Security. China also makes much of the equipment used in the industry. A Chinese state-owned company, ZPMC, provides 70 per cent of the world’s cargo cranes.

This level of control over global logistics and supply chains offers clear economic and security advantages, and reflect decades of policy decisions taken by both the US and China.

The shrinkage in the US shipbuilding industry is a result of several factors, say US shipbuilding experts, starting in the 1980s, when most government subsidies for shipbuilding were pulled, given that they were antithetical to the free market economics embraced by the Reagan administration.

While the 1920 Jones Act still requires ships that go between US ports to be built, owned and operated by the US, that traffic represents a small portion of overall maritime commerce. Reagan officials, many of whom were security hawks as well as free-marketeers, had initially thought that shipbuilding for the military during the cold war would create enough demand to sustain the US shipbuilding industry.

Much of the raw materials and components needed to produce new ships are no longer available in the US, thanks to the shrinking and outsourcing of the American manufacturing base, according to defence officials and unions. That’s a problem common in many industries, not just shipbuilding.

This, along with consolidation in the industry and the rise of cheaper ships produced in Japan, South Korea and most recently China, has led to lowered investment in things like technology, factory equipment and training for US workers. The result has been an overall decline in competitiveness and capacity in US shipbuilding yards, according to navy and union officials, as well as some labour economists.

The decline is of major concern not only to trade groups such as the Shipbuilders Council of America, says its president Matthew Paxton, but also to the industries that support shipbuilding.

USW president David McCall, who represents workers making everything from steel and engines to paints, cables and other products used in ships, notes that US steel mills are running at about 70 per cent capacity around the country. “If we could run capacity for more ships and the infrastructure to support them, it would create many more jobs which in turn would create more profitable facilities,” he says.

Indeed, it’s telling that the steelworkers’ union actually negotiates things like capital investment into the factories that support industries like shipbuilding as part of their own collective bargaining efforts.

In a globalised market, the workers have more incentive to seek investment in their industries than large public corporations that can place jobs or investments anywhere, according to McCall. “The CEOs that run these companies may leave after a few years, with golden parachutes, but we work in our communities for decades. We have to think about long-term security for workers,” says McCall.

This is a complaint that many on the labour left, and increasingly some on the political right too in the US, have made, particularly as it relates to industries in crucial or strategic sectors. With the breakdown of the US-led system of free market policies and institutions known as the Washington consensus, the supply chain vulnerabilities exposed by Covid-19 and wars in Ukraine and the Middle East, and the increase in economic and political tensions between China and the West, business as usual is increasingly challenged.

The Biden administration has made the reshoring of several crucial industries, including chipmaking and battery production, an explicit pillar of its economic strategy, though implementation of the new industrial policies has been mixed.

Rebuilding a workforce and factories from scratch takes time, and achieving the scale and high-speed iteration crucial to the cost-effectiveness and productivity of operations can take further years or decades of investment.

While there has been a hollowing out of shipyards and construction capacity, there are also problems higher up the value chain. The US Bureau of Labor Statistics predicts “little or no change” in the number of marine engineers and architects in the US between 2022 and 2032, while the job market for such careers in places like South Korea and China is booming.

To fill the gap, US officials have been turning to allies for help. Del Toro, the naval secretary, who has been concerned about the economic and security implications of the decline of shipbuilding in the US for some time, recently met officials in South Korea and Japan to encourage them to consider doing more production in the US, for the American market, in order to make up for their own loss of global market share to China.

This makes sense in theory, but the shortage of skilled US workers and capacity is a clear concern for allies, which brings home the point that a viable commercial shipping industry and national security aren’t discrete problems, but are intricately connected.

Shipbuilding is about steel and workers, but it’s also about technology. The digital component of transport and logistics is arguably as crucial to security and commerce as what gets made in shipyards.

China has, over the past several years, rolled out the pre-eminent global logistical supply chain platform, Logink, which it is giving for free to various ports around the world. The worry on the part of the US administration, as well as many in the labour and defence communities, is that this could give Beijing a window into global supply chains — both commercial and military — that would be both a competitive issue and a national security concern.

As a recent Department of Transportation Maritime Administration warning put it, “Logink is a single-window logistics management platform that aggregates logistics data from various sources, including domestic and foreign ports, foreign logistics networks, shippers, shipping companies, other public databases, and hundreds of thousands of users in the PRC.”

The warning further states that “the PRC government is promoting logistics data standards that support Logink’s widespread use, and Logink’s installation and utilisation in critical port infrastructure very likely provides the PRC access to and/or collection of sensitive logistics data”.

Michael Wessel, a commissioner on the US-China Economic and Security Review Commission, calls it “a serious self-inflicted economic and national intelligence wound”.

Last month, President Biden signed an executive order designed to strengthen cyber security at US ports, and directed billions of dollars into new infrastructure amid concerns that hackers from China could exploit these facilities to create havoc with supply chains.

The massive geopolitical power shift in shipping is due in large part to China’s aspiration, starting in 2001 (the same year it entered the WTO), to dominate global shipbuilding. Beijing had at that point designated the industry as “strategic”, which meant massive WTO non-compliant subsidies, limits on foreign partnerships, and other anti-competitive policies.

In 2006, it became one of the seven strategic industries over which state-owned enterprises should maintain control. In 2015, as part of the Made in China 2025 plan, Beijing identified shipbuilding as one of the ten priority sectors in which China would seek to dominate global commerce by 2025.

Since then, the Chinese shipbuilding industry has enjoyed policy loans from state-owned banks, equity infusions and debt-for-equity swaps, below market rate steel inputs, tax preferences and grants from export agencies, as well as protection from foreign ownership.

All of this is outlined in the 301 petition, which puts forward a case that China simply isn’t playing by free market rules, and that US law allows the president to act to remedy the situation since it poses a threat to American commerce.

The petition also notes that a more traditional trade remedy adjudicated at the WTO wouldn’t address the issue, since the majority of ships produced in China are used in international commerce rather than being imported to the US. “You simply can’t compete with subsidised Chinese products [in the global marketplace],” says McCall. “We need to reinvent industrial policy in America.”

The big question now is whether the Biden administration, which has tried hard in recent months to stabilise US relations with China, will take up the petition, and if so, how quickly they will do it.

In this, election politics may have a role to play. The proposals would have strong appeal to a Trump administration, particularly one with China hawk Robert Lighthizer as the US trade rep. If Biden doesn’t quickly accede to them, he risks losing labour support, and/or looking weak on China.

Some on the left have floated the idea that the reshoring of shipbuilding jobs might help make up for the labour that will be lost in the electric vehicle transition, which is estimated to require roughly 40 per cent as many workers as cars made with traditional combustion engines.

The case also has major international stakes. Missile attacks in the Red Sea and worries over Taiwanese sovereignty have brought the importance of naval power back into the global discussion.

Meanwhile, the disruptions of the past few years have highlighted the risks of a “just in time” approach to commerce, pushing policymakers and business leaders to think more about resiliency and redundancy in the most strategic industries.

The subsequent move towards more industrial strategy has also led to complaints about the subsidies being offered in the US in areas like chips or clean technology, which some consider protectionist. And yet, concern about Chinese dumping in areas such as electric vehicles is growing too, in Europe as well as in the US.

However the Biden administration responds, the case calls into question the role of industrial policy in fair and secure market crafting, as well as the need for a new global trading paradigm — one that accounts for state-run systems, and acknowledges the challenges that free market economies and public corporations governed by short-term, shareholder concerns have competing with them.

In the meantime, the Americans and Chinese are each brushing up on the thinking of Alfred Mahan, the 19th-century military strategist and author of The Influence of Sea Power Upon History.

As he put it, “The necessity of a navy, in the restricted sense of the word, springs . . . from the existence of a peaceful shipping, and disappears with it, except in the case of a nation which has aggressive tendencies, and keeps up a navy merely as a branch of the military establishment.” Then, as now, merchant shipping and military might are intertwined, not only as potential instruments of war, but of peace.

News

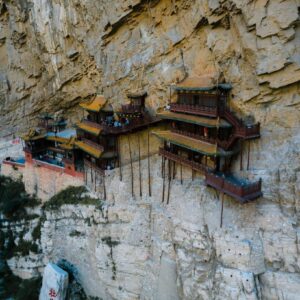

The Hanging Temple: China’s 1,500-Year-Old Cliffside Marvel of Faith and Engineering

The Hanging Temple: China’s 1,500-Year-Old Cliffside Marvel of Faith and Engineering Perched precariously on the cliffs of Mount Heng in Shanxi Province, China, the Hanging Temple, also known as Xuankong Temple, Hengshan Hanging Temple, or Hanging Monastery, is an architectural…

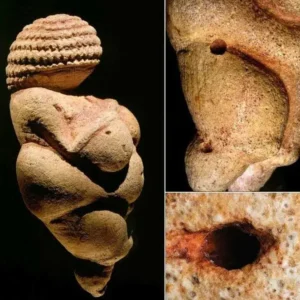

The Willendorf Venus: A 30,000-Year-Old Masterpiece Reveals Astonishing Secrets

The Willendorf Venus: A 30,000-Year-Old Masterpiece Reveals Astonishing Secrets The “Willendorf Venus” stands as one of the most revered archaeological treasures from the Upper Paleolithic era. Discovered in 1908 by scientist Johann Veran near Willendorf, Austria, this small yet profound…

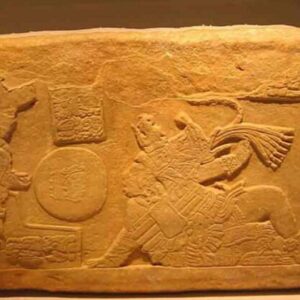

Unveiling the Maya: Hallucinogens and Rituals Beneath the Yucatán Ball Courts

Unveiling the Maya: Hallucinogens and Rituals Beneath the Yucatán Ball Courts New archaeological research has uncovered intriguing insights into the ritual practices of the ancient Maya civilization. The focus of this study is a ceremonial offering found beneath the sediment…

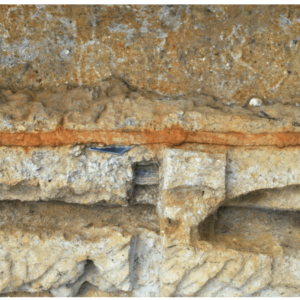

Uncovering the Oldest Agricultural Machine: The Threshing Sledge’s Neolithic Origins

Uncovering the Oldest Agricultural Machine: The Threshing Sledge’s Neolithic Origins The history of agricultural innovation is a fascinating journey that spans thousands of years, and one of the earliest known agricultural machines is the threshing sledge. Recently, a groundbreaking study…

Nara’s Ancient Sword: A 1,600-Year-Old Protector Against Evil Spirits

Nara’s Ancient Sword: A 1,600-Year-Old Protector Against Evil Spirits In a remarkable discovery that has captured the attention of archaeologists and historians alike, a 7.5-foot-long iron sword was unearthed from a 1,600-year-old burial mound in Nara, Japan. This oversized weapon,…

The Inflatable Plane, Dropped Behind the Lines for Downed Pilots

Experimental The Inflatable Plane, Dropped Behind the Lines for Downed Pilots The Inflatoplane from Goodyear was an unconventional aircraft developed by the Goodyear Aircraft Company, a branch of the renowned Goodyear Tire and Rubber Company, also famed for the Goodyear…

End of content

No more pages to load