Eamonn Holmes is reportedly getting closer to a relationship adviser who is 22 years younger than he is.

When the prominent GB News presenter, aged 64, declared in May that he and his wife, Ruth Langsford, 64, were splitting up it sent tremors through the celebrity world.

For the most part, Eamonn has remained tight-lipped about the split, bar expressing gratitude for fan support via GB News towards himself and Ruth.

However, backstage whispers suggest he’s finding solace in Katie Alexander, a 42-year-old mother of three.

Insiders report that Katie had dropped by to see the dad-of-four at his new place in the last couple of weekends.

After announcing his separation from Ruth, Eamonn opted to move out of their lavish home.

Now, observants have spied Katie visiting the presenter at his rented flat in South West London, journeying from her Yorkshire home, as reported by The Sun.

A photo surfaced last week depicting Eamonn at a February safari park, a blonde woman visible via the vehicle’s back window creating further speculation.

This follows an incident where Ruth reportedly discovered correspondences between Eamonn and an unknown woman on her husband’s laptop. An insider revealed to The Sun on Sunday: “Ruth was completely taken by surprise when she saw the messages. She had no idea what had been going on between them. She was devastated. Not only was she very upset but she was also angry,” reports the Mirror.

After Katie interacted with one of Eamonn’s posts on what was once referred to as Twitter, it is reported that the two became acquainted. The news anchor had been present at a charity fundraising event in Yorkshire – near where Katie resides – and took on the role of a patron, if reports are to be believed.

Ruth is said to be ‘raging’ considering her lack of knowledge about the pair’s friendly relations, which has now become public. Nevertheless, Ruth’s pals, including Homes Under The Hammer host Lucy Alexander, have offered their support during this time.

Using social media, Ruth mentioned she spent her days alongside her mum and cherished dog, Maggie, in the garden. Replying to Ruth’s post, Lucy recommended: “Just what you need – mum and Maggie cuddles… I reckon you should have a swig of Joan’s sherry [laughing emoji] love you.”

Ruth and Eamonn, who share a 22 year old son, Jack, appeared to be living the dream with successful careers. However, rumours have surfaced in recent times alleging a rocky state in their marriage.

In May, a joint statement from the couple’s representatives announced: “Ruth Langsford and Eamonn Holmes have confirmed their marriage is over and they are in the process of divorcing.”

The duo had spent 27 years together before making the decision to part ways. Despite all this, both Eamonn and Ruth have been observed still wearing their wedding bands, Eamonn while returning to GB News and Ruth when glimpsed running errands in Surrey.

Since the news broke, it has been claimed Eamonn had been left “blindsided” by the announcement, which his former wife reportedly orchestrated. Although Ruth has yet to speak publicly about the split, Eamonn previously thanked fans for their ongoing support

Follow us to see more useful information, as well as to give us more motivation to update more useful information for you.

Source: New York Post

Understanding Deductibles in Insurance

What is a Deductible?

A deductible is the amount of money a policyholder must pay out-of-pocket before an insurance company begins to cover the remaining costs. Deductibles are a fundamental component of most insurance policies, including health, auto, home, and business insurance.

How Do Deductibles Work?

When you file a claim, you are responsible for paying the deductible amount. Only after this amount is paid will the insurance company pay for the covered expenses exceeding the deductible. For example, if you have a $1,000 deductible on your car insurance and incur $3,000 in damages from an accident, you would pay the first $1,000, and the insurance company would cover the remaining $2,000.

Types of Deductibles

- Fixed Dollar Deductible: This is a specific amount you must pay each time you file a claim. It’s common in health and auto insurance policies.

Percentage Deductible: In some cases, particularly with homeowners insurance, the deductible might be a percentage of the insured value. For instance, if your home is insured for $200,000 and you have a 2% deductible, your out-of-pocket cost would be $4,000 before insurance covers the rest.

Per-Claim vs. Annual Deductible:

Per-Claim Deductible: You pay the deductible every time you file a claim.

Annual Deductible: Common in health insurance, this deductible resets each year. You pay out-of-pocket until your total expenses reach the deductible amount for the year.

Why Do Deductibles Exist?

- Cost Control: Deductibles help keep insurance premiums more affordable. Higher deductibles typically result in lower premiums because the policyholder assumes more initial risk.

Reduced Claims Frequency: Deductibles discourage policyholders from filing small or frivolous claims, reducing the number of claims an insurer must process and pay out.

Shared Responsibility: Deductibles ensure that policyholders share in the financial responsibility of their care or damages, promoting cautious behavior and maintenance of insured assets.

Choosing the Right Deductible

When selecting an insurance policy, choosing the right deductible is crucial. Here are some considerations:

- Financial Ability: Assess your ability to pay the deductible in case of a claim. A higher deductible can lower your premium but may be challenging to pay if an incident occurs.

Risk Tolerance: Determine how much risk you are comfortable assuming. If you prefer lower out-of-pocket costs during an emergency, a lower deductible might be preferable, albeit with a higher premium.

Frequency of Claims: Consider how often you might need to file a claim. If you anticipate frequent claims, a lower deductible might be more cost-effective over time.

Impact on Premiums

The relationship between deductibles and premiums is inverse. Generally, the higher the deductible, the lower the premium, and vice versa. This trade-off allows policyholders to customize their insurance based on their financial situation and risk appetite.

Conclusion

Deductibles are a key feature of insurance policies that influence both the cost of premiums and the financial burden on policyholders when filing claims. Understanding how deductibles work and carefully selecting an appropriate deductible can help balance cost savings with financial protection, ensuring optimal insurance coverage tailored to individual needs and circumstances.

News

Billy Ray Cyrus Blasts Ex-Wife Firerose in Furious Audio: Dubs Her a ‘Fl’ and ‘Selfish B*tch,’ Accuses Her of Family Destruction, Causing Miley Cyrus to Cut Off Contact

A bitter Billy Ray Cyrus is leaving achy breaks hearts everywhere in his wake after he was caught trashing both estranged wife Firerose and ex-wife Tish Cyrus in a tirade caught on tape and leaked last month. Sources tell RadarOnline.com…

Miley Cyrus Embraces Cheeky Antics with Fans in Front of a Cr0wd

Miley Cyrus Embraces Cheeky Antics with Fans in Front of a Crowd Miley Cyrus gave a sensational show at the “Bangerz” Tour in Washington, D.C., wowing fans with her captivating stage presence and impressive vocals. As the lights dimmed and…

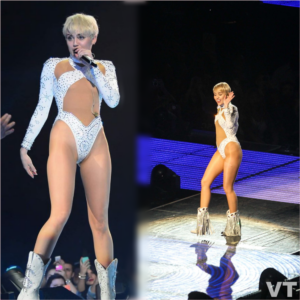

Pants-Free Zone: The Unforgettable Experience of a Miley Cyrus Show

You will never see Miley Cyrus wearing pants during one of her performances.

“Miley Cyrus Goes Bold in LA, Spotted Without Bra and Trousers During Lunch”

Singer Miley Cyrus spotted exiting Wokcano Restaurant in LA

Unbelievable Performance: Miley Cyrus Surprises Fans with Unexpected Prop on Stage

If you missed it, the reigning queen of controversy Miley Cyrus showed up unexpectedly at G-A-Y club night in London over the weekend. The night was filled with topless dancers, a whole lot of profanity, and even a giant inflatable…

“Beach Bliss: Miley Cyrus and Maxx Morando’s Relaxing Getaway in Cabo San Lucas”

She started dating the drummer in November when they were photographed together at the Gucci Love Parade fashion show. Last Saturday, Miley Cyrus was seen soaking up the sun in Cabo San Lucas, Mexico, wearing a trendy black swimsuit while…

End of content

No more pages to load